One of the most common, and important, questions I am asked is some variation of: “Can I accept out-of-pocket payments from a Medicare patient?” The very short answer to this is: “it depends.”

Working with Medicare patients on a Private-pay Basis

Some Physical Therapists may assume “If I’m solely a fee-for-service practitioner and a Medicare beneficiary wants to see me and is happy to pay me out-of-pocket, that’s their choice and I should be able to take that payment.” But everyone knows what happens when you assume …

[Please Note: The information in this post is specific to 100% Private Pay Physical Therapy practices which do absolutely no billing to Medicare.

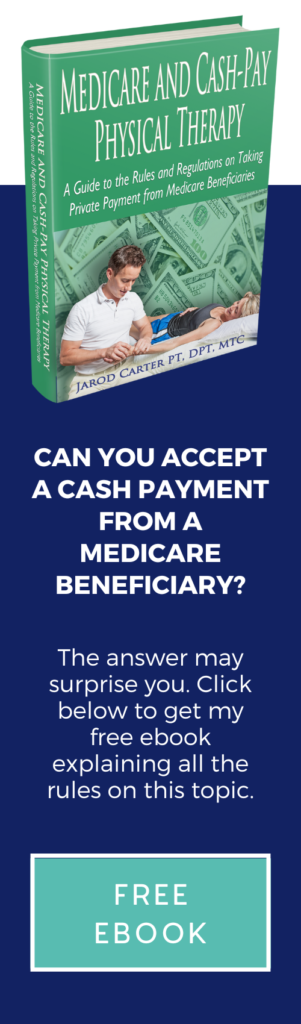

A full overview of this topic that includes Medicare Participating and Non-Participating providers can be downloaded for free here.

With that said, this post has a number of ideas and great comments/questions below that you should make sure to read if you are interested in Cash Based PT]

I received most of this information from an organization which prefers its staff not be referenced or quoted. Just to be safe, in case my interpretations are not perfect, I am refraining from identifying the organization at all, though I imagine you can guess which one it is.

It took quite a while to get clear answers about all the components of this topic. To be honest, some answers could use further clarification—but I sensed I had thoroughly annoyed the ‘answer people’ and could tell I’d be burning bridges if I continued the barrage of emails. Even so, I gathered quite a bit of info, and it should serve as a decent guide for us.

Basic Medicare guidelines for a cash-pay practice

If a non-enrolled Physical Therapist provides services to a Medicare beneficiary that would normally be covered by Medicare, he/she is required to bill Medicare directly and is not allowed to accept self-payment for these services. The Social Security Act has a mandatory claims submission requirement, so a Physical Therapist cannot choose to not enroll in the Medicare program And collect cash from a Medicare beneficiary.

If the service is “non-covered” (e.g. “prevention, wellness, fitness”), then a Physical Therapist can collect out of pocket payment from the beneficiary; but only in those circumstances.

When you hear about health care practitioners “opting out” of Medicare, please know that this is a actually a different scenario than that described above. Physical Therapists are not included in the list of practitioners who can “opt out” (outlined in the Balance Budget Act of 1997 and Medicare Prescription Drug Improvement, and Modernization Act of 2003).

However, this does not mean we are required to accept Medicare beneficiaries as patients. It is always our choice as to who we accept as a patient; but if that patient is a Medicare beneficiary then we can only accept self-payment from them if the services are considered “non-covered” by Medicare.

With this information, I then investigated these “non-covered” services with the labels “prevention,” “wellness,” or “fitness.” More specifically, how do we know for sure when we can say we are providing this type of service?

Based on the answers I received to this question, it sounds like it is largely left up to our professional judgment. Of course that judgment should be very specifically backed up with solid documentation. If you can document that the patient is not at your clinic due to a specific pain/injury/dysfunction, but rather to maintain a certain level of wellness/strength/fitness or prevent issues such as falls or health decline, then you should be able accept out-of-pocket payments from them.

What if the patient has reached/exceeded their therapy cap? Can I then accept cash payment from them even if it is for services normally covered by Medicare? I was told that if there is not an exceptions process in effect, you can accept self-payment in these instances.

If a cap exception process has not been attempted, you should obviously inform them of this possibility.

To get the whole, and most up-to-date, story on this topic PLEASE also read:

The Cash PT & Medicare Quick Start eBook. It’s completely FREE and gives a full overview of this entire topic

Also see some other Medicare-related articles:

Update on Cash-Based Physical Therapy and Medicare – Part 1 – A HIPAA Loophole

So what does all this mean for a cash based PT practice (that is Neither a Participating Nor a Non-Participating Medicare provider)? It means that although you cannot take self-payment for therapy that would normally be covered by Medicare, there is a whole world of cash-pay services you can legally provide to this patient population.

Over time, I will expand on some specific ideas for such services and programs.

This is an article in which I feel compelled to repeat the disclaimer on this site: You need to verify anything stated on this site with your own professionals and do your own due diligence when making decisions. Plenty of what I said above could easily be misinterpreted and misused, so I assume zero responsibility in your use of this information.

I’m not trying to downplay the validity of what I’ve written … it took a lot of time and research to compile this info and I feel confident in my understanding of this topic. I’m just making sure to cover my legal bases, and ask that you always double check everything before acting on it.

With that said, if you appreciated this article and all the questions it answered, please share it with your colleagues below.

If you want every last detail on medicare and Cash-pay physical therapy, check out the full length guide book here.

I have a current client that is on medicare. When I informed her that we would be going to cash based, she contacted Medicare. They totally misinformed her and told her she could pay and seek reimbursement. Thank you for your clear explanation hopefully that will help her better understand.

Congrats on going cash-based Brenda! Yes, you never know who you’re going to get when you call CMS, and you can rarely rely on the info you receive from the first person you speak with there. Perhaps once you’ve brought this patient to a certain point, and can document that the care has become “maintenance,” you can continue seeing her on a self-pay basis? Good luck and please let me know how your transition to a cash-based practice goes … I’d love to interview you about the process once you’ve made change.

If we deem that it is in fact “wellness” or “maintenance” treatment and thus taking cash payment from the Medicare patient, are we will sending any sort of superbill out? As far as I am aware, Medicare does not reimburse for wellness services… in that case, just document as normal and take the cash payment? Thanks!!

I went to my chiropractor after a possible back sprain to be adjusted and they advised me since they are cash based I cannot be treated by them . This is the same chiro that has been treating me gotten years so I don’t understand why mentioning a slight back pain got me tossed out of The Joint,

Thank you for posting this information. Documentation is key!

My pleasure Jennifer! This one took a good while to compile but was very worth the effort. Thanks for reading.

Thank you for this post! Very informative.

You’re very welcome Julie. Thanks for the comment

“Maintenance” is tricky too… The Medicare Advocacy Organization has been fighting “‘maintenance” and has had some wins. http://www.medicareadvocacy.org/InfoByTopic/PartB/10_03.PTSelfHelpPacket.pdf

One case continues in the court system: http://www.medicareadvocacy.org/2011/10/federal-judge-refuses-to-dismiss-medicare-beneficiaries-challenge-to-the-medicare-improvement-standard/ On October 25, 2011 Chief Judge Christina Reiss did not agree with the federal government to toss out the case.

Wow, Selena … Thanks so much for these links and great info.

I recently spoke with a Noridian Medicare representative and she verified the fact that I cannot opt out of the Medicare system. She did say there are two provider designations, a participating and non-participating provider. On Nov.15th, forms should be available on the website to switch to non-participating provider status. She called it open enrollment and I do not know if this extends to the end of the year or not. She said, a non-participating provider can accept payment from the Medicare patient up front up to the “limiting fee”. I do not know exactly what that it. The provider must do the billing but the reimbursement will go to the patient.

Thanks Mary, this is good info. It sounds like those willing to go through the hassle and expense of submitting the claims to Medicare (and hope it’s not denied) may be able to do so, but I wonder what the “limiting fee” is and if it is anywhere close to making the process ‘worth it.’ As we discussed in a comment above, I think it’s also wise to call CMS and ask the same question to multiple different people … I imagine you will not always get the same answer, and this is a subject you obviously don’t want to leave to chance. Make sure you document each call, who you spoke with, and exactly what they told you in case you have to utilize that info in the future. Thanks again for the comment!

This is a great post – very clear and easy to understand. I just went back into private practice 3 weeks ago, and I went through hours (no joke) of research to get the same answers you posted here! The whole process was incredibly frustrating, so hopefully your post makes it easier for PT’s to understand the answers. I was actually told by our local Medicare carrier that as a PT I could opt-out, and he even gave me the link to the opt-out paperwork! I asked 4 of my mentors and 3 said that this was ok, while only one said, “That is absolutely illegal and the person at the Medicare carrier has no idea what the definition of a practitioner is (and the fact that it doesn’t include PT’s!) I had a similar experience to yours with the “un-named professional organization” and had to keep emailing them to get a complete answer. Once it became clear to me that I could not accept any cash from any Medicare patients, I started thinking about Wellness and trying to find an actual definition of what the dividing line is between formal PT services and Wellness provided by a PT. I have been unsuccessful in finding that information, so I will check the other links in your post. It would seem that the “un-named professional organization” would come out with a document similar to this post, which would answer the questions! Sadly, out of all of the therapists I have talked to about this, only one knew the actual law. Once I shared the info on my blog and Facebook page, I had many other therapists contact me to say that they had no idea they shouldn’t be taking cash from Medicare patients if they run a cash based practice. Thanks for a nice, concise article. I’m putting in the link to my article on the same topic:

http://prana-pt.com/2011/11/02/gotta-love-autocorrect/

Thanks so much Ann. I read your blog post too – very nice! Your commenter stated something that I have heard a number of times when I’ve had to tell seniors I can not accept them as patients … the idea that it is ‘unconstitutional’ to prevent someone from being able to pay out of pocket for a service they feel is best for them and will gladly pay for. I couldn’t agree more. The APTA is so wrapped up on a yearly basis in getting the Medicare Cap extended, that I wonder if they’ll ever have the time/money/ability to work on adding Physical Therapists to the list of ‘practitioners’ who can opt out. Please let me know if you ever hear anything about efforts in this area, and I’ll do the same. Thanks again for the comment.

Thank you for your article and information. I entirely agree with your observations and appreciate finding likeminded clinicians speaking out. I am a strong critic of my profession and I do my best to stay informed, educated, and honest in my work. I too have a patient who is a Medicare beneficiary as well as UHC as a secondary, and he too was informed that he may pay cash and submit reimbursement with a letter explaining why he cannot receive treatment at another PT. It is important to note that Medicare considers “intentional deceit” to include not doing due diligence, however it is sad that one must question the information received from the very organization making the rules.

Abraham, I really appreciate the info on “intentional deceit.” Thanks for posting!!

Hi Dr. Jarod… I’m just starting my homework on cash pay PT practice… run of the mill factory work physical therapy is not getting me or my patients anywhere… I’ve thought and had decided to not mess around with insurance…then some friends mentioned that it was pretty easy to submit. I wondered how one could use the word easy, insurance and claim in the same sentence. So now I’ve stumbled upon your site and it was the boost I needed to not mess with the insurance issue. I’m in a bit of a quandary however, I would love to be able to make cash pay home visits for those not able to get out to see me. I’ve done home health for 15+ years before returning once again to the clinic and I have a very soft, compassionate spot in my heart for these people.

I’ve considered just getting my MT cert so I can ditch the whole Medicare issue… but then I also considered this… my primary treatment approach is John F. Barnes Myofascial Release (MFR). I’m a Personal Trainer as well… I can always see someone for stretching right?! So, my services will be that of a personal trainer doing AAROM, AROM, PROM for and with my patients… any thoughts?

I’m giving my website a re-do and will be including a lot of MFR information as well as encouraging patients to seek out cash pay PT’s… I’ve seen so much fraud in home health care i.e. 10 minute visits etc… I figured that cash pay PT’s are ready to give quality work. I’m not thinking that many are not interested in billing Medicare though. Nonetheless, will have some cash pay PT pages on my site including a directory where cash pay PT’s can be listed in by state so patients can find them.

Thanks for the post! I’ll be looking at your site A LOT more in the coming days!

Hi Marcia,

I’m so glad this site could be an inspiration and resource. It sounds like your focus is on the well-being of your patients so I’m sure you will be successful. You raised some interesting points in the second paragraph and asked for my thoughts, so here goes … I do know of PTs who earned their Massage Therapy certification and Personal Training cert, but it was more as a way to get around the referral requirement nonsense in Texas than it was to avoid Medicare hang ups. My advice here would be to use extreme caution and find a good lawyer in your state to give you clear answers on whether or not this approach is legally viable. I once heard that if you have more than one license, you are held to the standards and requirements of the “higher level” license. ie if your hold both PT and MT licenses you would still be considered a PT first in the eyes of CMS and your PT State Board. With that said, I can’t remember where I heard that and I have not had my lawyer confirm it. I just wanted to mention it since you are thinking of going in that direction. It’s absolutely absurd the public can go directly to a Massage Therapist or Personal Trainer without a referral but can’t do so for many of us PTs … and then Medicare beneficiaries can pay them cash for hands-on treatment and “stretching” but not us. However, no matter how ridiculous it is we have still have to follow the laws and make our decisions based on due diligence.

Please let us know if you find out more on this topic of “getting a massage or personal training license” in order to avoid issues with Medicare and Direct Access.

Hi Dr. Carter…

Well… my quest for answers somewhat continues and is somewhat resolved.

First, although this does not answer the “higher standard” of holding two licenses, many PT’s can sit for the licensing exam through “Portfolio Review.” This is found here – http://www.ncbtmb.org/applicants_portfolio_review_handbook.php

A PT friend of mine told me that she went to a billing course and as long as you are providing a service to a Medicare patient that they can’t find elsewhere, you can accept cash. This fits better with my model of providing John F. Barnes Myofascial Release therapy – it is my sole focus on patients. We are few and far between in rural Indiana! If you provide a specialized service that patients are not able to access elsewhere – it seems you are allowed to accept cash (although I know Medicare and CMS don’t care about what “seems” right or reasonable!)

You bring up a great point about being held to the higher standard which makes me wonder if sitting for the Massage and Bodywork Board is worth the effort. I’ll have to ponder that for a bit, however, am still leaning towards this as many of my clients don’t NEED to go to the doctor, they just want to “feel good” and MFR is so effective that it not only makes one feel great, it also treats them “through the back door” if you will and resolves things that could poise health threats down the line.

I think our best bet as PT’s wanting to provide exceptional service is to be sure we have as script, as you have said, that states that PT is needed for maintenance, prevention, wellness or fitness.

Thanks for your information Dr. Carter!

Oh – a Personal Trainer certification goes a long way too! I think I read that you have your personal training certs… (I recommend ACSM – the benchmark).

Marcia

Great comment Marcia.

Your friend’s idea of “as long as you are providing a service to a Medicare patient that they can’t find elsewhere, you can accept cash.” is an interesting one. I imagine this may actually be defensible in rural Indiana, though probably not in any urban areas. Something to consider also is that if you get called on it, you may find yourself going through a lengthy legal process of proving that what you provide is truly not available otherwise. This topic is so frustrating, isn’t it?!

I also like the idea you mentioned about having a Physician script that uses the “non-covered” terms of “maintenance,” “wellness,” etc. It’s not something I considered before but may look deeper into the legality of this approach. Thank you again!

I agree the “accept cash if the service is not available elsewhere” can be sketchy but I specialize in John F. Barnes method of myofascial release so, although I’m not willing to push my luck, surrounding PT’s would need to show proof of NOT having taken his classes…

I’ve talked to other therapists who have the doctor write the non covered words on the script so that they have a script in hand, give the patient an ABN and then the patient can pay cash…

Best Regards – thank you for your reply to my interview question!

I am pursuing a cash based PT practice. I too had considered using my massage therapy designation rather than PT license to allow me a ‘more inclusive/integrative approach to care. In consulting with some IMT practitioners on the East Coast they commented that their research indicated that the highest degree superseded all other training. In essence my PT licensed, though more highly trained, limited my skills and breadth of treatment. With this understanding, I realized that for my interests and values, I would probably need to pursue a chiropractic, naturopathic or PhD license in integrative medicine to do what I love to do and treat the whole person.

In California there is a law that allows PTs to treat more holistically. In Washington state most PTs are fearful of their license being in jeopardy.

I would GE interested in connecting with others who have info that clarifies the Medicare age population, the ability to serve that population without incrimination.

I too would be interested in bringing such professionals together!

The whole “using the massage license” topic is a tricky one that definitely requires legal counseling to safely pursue. I know of a PT who works part-time at a PT clinic and is bound by direct access issues; and she also has her own massage therapy practice in which there are not referral/access issues, but she has been instructed by her attorney to not even suggest a stretch or exercise to her massage clients. It is absolutely ridiculous, and without changes in a few different laws, we will remain heavily limited in who we treat and how we can treat them (and especially MC beneficiaries).

Hi! Your information has been extremely helpful! I found this in the NYS Physical Therapy Practice Guidelines – Advertising and Specialty Credentials (http://www.op.nysed.gov/ptg12.htm): “A licensed and registered physical therapist or physical therapist assistant who wishes to perform activities that do not require a license (e.g., Pilates or personal training) may face charges of misconduct for alleging professional superiority and advertising that is not in the public interest. Such licensee may choose to make the professional license inactive to avoid confusion.

So I’m wondering if I inactivate my physical therapy registration and had a personal training certification (or another certification, such as the FallProof program)if I would be free to work with Medicare patients on a cash pay basis.

I did find out there is a bill out there that includes a provision for PT’s to opt out of Medicare. It’s from the PPS/APTA to the Ways and Means Committee. Here is the information:

“PPS/APTA recommends Congress extend to physical therapist the policy allowing these professionals to collect out of pocket from a Medicare beneficiary. Such an amendment would , afford beneficiaries the freedom of choice they deserve, without resulting in any greater expenditure, in fact quite likely some modest savings, for the Medicare program.

Private Practice Section September 20, 2011 American Physical Therapy Association Statement to Ways and Means Page – 3 Expiring Medicare Payment Provisions

PPS/APTA recommends That Section 1802(b) (5) (B) of the Social Security Act be amended as follows:

Inclusion of physical therapists under private contracting authority.

Section 1802(b)(5)(B) (42 U.S.C. 1395a(b)(5)(C)) is amended by striking “the term practitioner has the meaning given such term by section 1842(b)(18)(C)” and inserting “In this subparagraph, the term “practitioner” means an individual defines at section 1842(b)(18)(C) or an individual who is qualified as a physical therapist.”

Thank you for this great source of information for us all. I hope my information helps.

Thanks for all the great info Cindy. We really appreciate it.

To answer your question, if you were to let your PT license lapse and then work with individuals as a certified personal trainer, I imagine you would then only be limited by the rules and regulations of that profession (which tends to be on a cash-pay basis and does not limit its members from working with specific populations/ages). With that said, if you give up your PT license and function only under a personal training certification, you would then have a different set of limitations on what you can provide to your clients… i.e. as a personal trainer, it wouldn’t be okay to perform hands-on manual therapy techniques, etc. With that said, the personal training profession seems to do little-to-nothing to police its members and make sure they are not stepping outside of their professional scope of practice, and (unfortunately) you could probably get away with quite a lot in this arena.

It’s an extremely unfortunate and ridiculous scenario that any of us would consider dropping our PT License (and obtain a certification that you can get online in less than 3 months) in order to have more freedom to practice and help people. But you are not alone in considering this option, and I completely understand where you are coming from. I know of Physical Therapists who have already done so. Hang in there.

What a Ponzi scheme Medicare is. You can’t opt-out. You must bill Medicare. Medicare is going broke. You can’t treat Medicare patients without billing Medicare. The whole system is criminal; that along with social security. Eventually, there will be a bottom ladder step of people that are left holding the bag like any pyramid scheme. Ok, sorry for the rant. I’m not a PT but I owned a number of fitness and rehab centers that employed MDs, PTs, DCs, exercise phys., pilates instructors, etc. The service was unbelievable. People actually got better and changed their lifestyles. Isn’t that the ultimate goal? I’d say the answer to treating medicare pts, as you alluded to, is to have acute (medicare) injuries treated by a “friendly” PT and have the pt. come back for exercise and all other “uncovered services” until Medicare goes broke. Then, you’ll be able to provide a respectable and comprehensive service.

Great info thanks! I am wanting to make my practice more of a cash-based practice. When setting rates, is it illegal to charge a flat rate per visit? Also how much of a cash discount are we allowed to give with the fear of offering multiple rates since I still bill insurance?

Sorry for the delayed reply on this Samuel. I know you are already getting some great info from the Linked Group for Practice Owners http://www.linkedin.com/groupItem?view=&gid=114602&type=member&item=100570485&qid=24f938bd-dce9-49b2-ab88-5aa747a9e1c4&trk=group_most_popular-0-b-ttl&goback=.gmp_114602

But just to reiterate some of what’s being said there… it’s always best to consult a lawyer on these specific questions of legality, and also know that what is legal in one state may not be in another. Also, what one insurance company is okay with, may not be the case with another. I DO know that if you are 100% private pay, charging flat rate for each visit is fine but you still may need to break the charges into multiple units on receipts so the patient can use for a self-claim.

So, just to clarify, if a PT sees only nonmedicare beneficiaries (even if they have private insurance), then they can be 100% cash based and not mandated to file any insurance claims even if the service is covered by a private policy? Or did I completely misunderstand?

Yes, Beth. If you are not in network with any private insurances then you can not be mandated to file claims with any of those companies. Most of my patients do have insurance but I never send in claims myself. Many of them send in self-claims but it is their responsibility to do so if they want reimbursement. Some hybrid cash-practices who are completely out-of-network with private insurance companies do send in claims for their patients as a courtesy but they are not mandated to do so. Again, we are talking about private insurance companies … Not Medicare. Medicare has a “Mandatory Claims Submission” for any services that would normally be covered under Medicare.

I came across your comments here looking up similar info for a friend who is retired Air Force. She’s been seeing a counselor for several years who did not accept her TriCare insurance, so she paid the counselor with cash and did not file an insurance claim because she wanted to keep seeing this particular counselor. My friend is now on disability (she’s not yet 65) and as a result Medicare pays before TriCare. A couple of weeks ago the counselor told her that she was informing all of her Medicare patients that she could no longer see them because even though they paid case, Medicare would not let her see patients who were on Medicare because she did not accept Medicare assignment. My friend was devastated, having served the government for years to secure our country’s freedoms, she couldn’t understand how they could tell her that she couldn’t use her own money to pay to go to the counselor she wanted to see. I told her my belief is that the government is working to force all medical professionals to accept Medicare assignment, or risk losing clients, then will be reducing the payment of assignment, to be able to have national health care, control cost and determine the specifics of what that health care would and would not cover. I wish there was a way to inform more people of this limitation of their right to decide who they are able to see for medical care, mental health care, rehab care, etc. I think they’d be as angry as she was about the situation and maybe they’d be able to bring about a change. But few people understand this rule and are too stunned to fight it while they are seeking help. I hope you professionals get together and educate your clients about how wrong and limiting this Medicare rule is.

Yes, Deborah … It’s an absolute shame. We are trying to educate the public as much as we can, but unfortunately this law/rule is not at the top of the priority list for our profession’s lobby. They are so busy fighting to maintain the “scraps” that Medicare pays for our services, that they have no time or money to try and change this ridiculous law. Thank you for taking the time to comment and give your opinion.

Hi

I was wondering if you could comment on the difference between being a non participating provider for Medicare and opting out. Due to the Social Security Act we can not “opt out” and accept cash for PT services. However, has a non participating Medicare provider who does not accept assignment for Medicare we can accept cash at time of service based on the physician fee schedule and submit the claim to Medicare and the patient would get reimbursed directly from Medicare.? My question is, does the SSA override the non participating agreement thus making it illegal to charge patient’s cash at time of service? Thanks for your thoughts.

Hi Emily,

Thanks for the question. Please see this post for an overview: https://drjarodcarter.com/medicare-self-pay-physical-therapy/

The quick answer to your question is “No, the SSA does not interfere with the Non-Par collection process, which you described well above (but note: as a non-par provider, you can charge up to 115% of the MC fee schedule).

So are there any barriers/legal implications to treating a Medicare beneficiary pro bono? I have a cash-based PT practice and typically work with younger individuals (many athletes), so I have not had to deal with this issue yet. Obviously, am not credentialed with Medicare. I have a family friend who has struggled in “traditional” physical therapy following a total ankle replacement (6 months ago)….and might benefit from some gait training in addition to other interventions. I believe I might have a difficult time selling this interaction as wellness/maintenance but would like to help her out nonetheless, even if only for a short time. Thus, I am considering working with her pro bono. Or is Medicare so controlling that even this is an issue? Any thoughts, Jarod?

That’s a great question, Ryan. You would think that Medicare would not object to you not charging a beneficiary and not charging them either, but you can never assume anything with CMS. I unfortunately can’t give a set answer on that one and would have to refer you to an attorney who knows Medicare well. If you want to avoid that expense, you may want to check out the Social Security Act and find the section on Medicare’s “mandatory claims submission” requirement … this is the reason that anyone treating MC beneficiaries for covered services (even Non-Participating providers) must send the claim directly to Medicare, BUT I don’t know if that extends to covered services provided for free.

Jarod, thanks for the guidance. Following your road map to the end yields this document: http://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNMattersArticles/downloads/SE0908.pdf.

Check out the “Exceptions to Mandatory Filing” portion. It appears that one does not need to submit a claim for providing covered services to a Medicare beneficiary pro bono. And another piece of the puzzle fits into place…..

That’s awesome news! Thanks so much for posting your findings here, so that all of us can benefit.

Thank you so much for compiling all this information. I have been scouring the internet to find what you have laid out here and you really saved me a major headache. I’m not sure if you would know this from your research on the subject, but do you know if there is anything that can be done once a patient is treated, pays, then submits their claim to Medicare? We are an all cash practice, and have only treated this one Medicare patient. I am worried we will get fined since we are not registered as a Medicare provider, but I can’t justify the cost to file for just one patient that we will never see again (he lives on the other side of the country). Do you have any thoughts on this?

It sounds like you were not clear on the rules before treating this patient, but I have no idea if Medicare will let it slide just because you didn’t know the rules. The most thorough (but unfortunately costly) approach would be to do a brief consultation with an attorney so you can know what to say if Medicare calls to investigate the situation. I just published a full overview of the rules, as I understand them, that should help guide you with this situation in the future: https://drjarodcarter.com/medicare-self-pay-physical-therapy/

There is no case that I can find of any PT being investigated for breaching of this ridiculous rule. I know multiple PTs in private practice who are not MC providers and see cash paying Medicare patients. They know the rules and don’t view it as a real risk. These PTs document their care and bill the patient a fee not tied to any CPT code. No CPT code no skilled care provided. No skilled care to bill to MC. Also no need to follow MC billing and coding rules if not providing Skilled care that would be implied if using CPT codes. Simple.

I appreciate the comment Russ. I feel it’s my job to research and present the rules as clearly as possible, but it is of course everyone’s individual decision on how they interpret them and to what extent they follow them. I cannot agree more that this is a “ridiculous” rule. I too have not heard of anyone being prosecuted for a breach of this rule, but I do know of a cash-practice who received a warning call from CMS about it.

With all that said, I should probably note a few things since other readers may want to take your comment and run with it. The cash practices that I know of who ignore this rule and provide MC beneficiaries with services that would normally be covered by Medicare, purposely do not provide them with receipts. They do so because if the beneficiary were to try to use that receipt (regardless of whether or not it uses CPT codes) to send a self claim to Medicare, they could get in trouble. The statement “No CPT code no skilled care provided” is simply not going to hold up if you were really trying to defend yourself from CMS. Skilled Therapy does not become unskilled (and not covered) simply because someone didn’t attach a CPT code to their documentation or receipt.

Again, I’m not here to tell anyone what to do. To be honest, the risk probably is quite low. But that doesn’t mean it does not exist or could not have significant impact on my colleagues’ ability to practice and make money. So I just have to present it as straightforward as possible and let everyone decide for themselves what they do with it. Thank you again for bringing up this point, but I would be careful about how you define skilled therapy and the assumption that CMS would accept your definition based on the absence of documenting CPT codes.

Great, helpful article. I also really enjoyed the additional comments, questions, and your responses.

I am still trying to get clear on this. In my new cash practice- I specialize in pelvic physical therapy. I can also (with certifications) do personal training and sexual counseling. Two questions:

1. For all cash clients- can I have a different tier of rates i.e. – Physical therapy $100/hour, Personal Training $75/hour, sexual counseling $80/hour?

2. If it is a someone who has Medicare- I know I’m held to my highest license- PT…But, can I feasibly not use WebPT documentation for personal training or sexual counseling and just do a word-based document of exercises (without CPT codes) and give them a receipt for the $75/hour they paid with something that says exercise/prevention on it? I understand if they are hurt or my treatment is off, I can be held to my PT license. But, in terms of Medicare, is this delineation enough? In my area there are other therapists who do what I do with insurance, but people still seek me out because they want to see me specifically.

Hi Tracy,

Great questions but I’m gonna have to defer to an attorney on the majority of it.

1) You’re talking about operating in fields/realms I’m not familiar with and don’t know the laws/regulations for. I do know that if you are completely out-of-network, and not bound by contracts with any insurance companies or Medicare, it makes things much more simple and you can generally place your different rates at whatever the market will support. However, I can only say that in respect to Physical Therapy … not sure about the sexual counseling part of things and I imagine there could easily be regulations/laws that affect how you go about pricing/billing those clients. The best thing to do in this situation is to find a lawyer with experience in this area and verify everything with them.

2) This is another one that goes into details I’m not comfortable giving a set answer to (which I’m sure you can understand), so again, an attorney with experience in Medicare would be the person to ask. My general reaction to this question is to say that you can’t really switch from being a “PT” with some patients, but a “Personal Trainer” with others (Medicare or not). If something were to go wrong, I think you’d not only have issues with CMS but also with your State Board.

I wish I could give more specific answers but I can’t risk saying the wrong thing when it comes to Medicare and potential legal issues. If you consult with an attorney regarding these questions, we would all love to here what they have to say (and we would also understand that every state and every individual’s context/situation is different 🙂

Thank you for your excellent ongoing work. Trying to decipher this monolithic structure known as the Medicare system is a testament to your perseverance & patience!

Question: as a PT having nothing to do with Medicare, how do I find out if a MC beneficiary has reached/exceeded his cap so that I am within my right to treat & bill the patient directly? Do I request a benefits statement from CMS & place it in the patient’s chart as documentation?

In this situation, does being a PT with no MC involvement actually mean that I have to deal with MC? Labor intensive, defeats my purpose.

I would appreciate it if you would let me know the correct procedure so that I am in compliance with MC regs.

Many thanks.

If a patient comes to you after they’ve reached their PT cap (at another facility), they probably already know it and it may be something you could request of that former provider. Otherwise, yes I would inquire with CMS directly for documentation that the patient has reached the cap and does not qualify for the exceptions process (if that is a valid option in that given year). Outside of this request, I don’t think you’d be dealing with Medicare in a very time intensive way.

With all that said, I’ve never had a MC beneficiary come to me and say “I’ve reached my PT cap and want to continue treatment with you on a self-pay basis.” For that reason, you may get better guidance from PTs who are participating providers and already know who in CMS you call to acquire info about cap limits being reached by an individual.

For anyone reading this who has different or more direct guidance on who to call for this info, it would be greatly appreciated if you share it with us here. Thanks!

I have an independent cash-based practice and choose not to participate with Medicare. I offer a private Pilates lessons in addition to physical therapy.

Yesterday I had a very intelligent MC beneficiary (intelligent meaning she understands the system well) in for a complimentary physical therapy consultation. She used her cap in the end of 2012 in outpatient hospital-based services and continues to feel limited functionally due to upper and lower extremity impairments. She says that she has a surgical procedure planned for later this year, thus would like to preserve her cap in order to have PT services in the same hospital as the surgeon, so she would prefer to pay out-of-pocket for my services now.

I completely respect the rationale, but am nervous about the risks of treating her as a physical therapy patient. Because she has exhausted her benefit with these UE and LE conditions previously, do you think this episode would be considered “maintenance?” I realize that I may be able see her for Pilates as “fitness/wellness,” but know that she needs manual therapy and I wonder if the “PT trumps Pilates instructor” rule would still put myself at risk.

Any thoughts?

Since it’s 2013, she’s obviously working on a new PT benefit allowance. Manual Therapy is obviously not within the scope of a Pilates instructor, so you would be providing “skilled PT services” in this scenario. I know plenty of (non-participating) PTs out there who treat patients like this, make them promise not to claim anything with Medicare OR any other insurance, and don’t even provide receipts just to make sure. But I can’t recommend this approach because if you get caught, you could be totally screwed. I wish I had better news for you 🙁

Can a medicare patient explicitly not authorize you to bill claims and or release any medical information regarding care as long as they acknowledge that they can not and will not be reimbursed.

That would be a question for the attorneys at the APTA. If you find out something from them, please come back and let us know in these comments. Sorry that I can’t give a set answer on this one. Tricky legal stuff.

Very helpful information. I understand that Physical Therapists are not allowed to “opt out” of Medicare. But what if I start a cash-based practice and never apply for Medicare provider status in the first place? If this practice is never “in” with Medicare there is no opportunity to “opt out,” furthermore, will this practice be able to accept cash-payment from Medicare patients without having to professionally define “non-covered” “prevention,” “maintenance,” “wellness,” or “fitness” services?

Thanks for the question but it sounds like you may not have seen this other post on the Medicare topic: https://drjarodcarter.com/medicare-self-pay-physical-therapy/. It very clearly answers your question, and explains that choosing to have no affiliation with Medicare does NOT mean you can accept cash-payment from MC beneficiaries for covered services, or that you would not have the responsibility of defining a covered vs non-covered service.

What if we do a “don’t ask, don’t tell” kind of thing? The patient walks in, says they want personal training sessions with someone who works in our clinic who is not a licensed PT or PTA, but rather a Certified Fitness Trainer. They are carrying out their sessions while I, a PT, am seeing other clients with insurances other than Medicare.

Or another scenario: A client comes in, they are evaluated and charged by a PT, set up on a “maintenance program” with a Certified Fitness Trainer, advised to get massage from a Licensed Massage Therapist, and then once a month they return to the PT for re-eval to possibly upgrade their program. Any problem with that?

Hi Dylan,

Thanks for the comment but your questions are getting into tricky legal waters and I can’t really give a set answer to them. I can only present the rules as I understand them, while the interpretation of the rules must be done by each individual and hopefully their attorney. To that note, in scenario #2, PT evaluation is a “covered service” by Medicare so I would be careful there. In scenario one, if the PT is Not involved in their care or providing what would be “covered services,” I don’t see why you couldn’t have personal trainers providing fitness services on a cash-pay basis. Again, you need to check all this with an attorney.

In the scenario #2 above, the PT does the evaluation, which is a covered service, and it is billed by our company to Medicare. No problem with that. Then we set the appropriate exercise program for that particular phase of treatment for 4 week period of time, there is no interaction with the PT, just the certified fitness trainer. You mentioned above I would have to be careful in this scenario. What do you see as being the questionable part?

When I worked in SNF’s, I frequently did similar things where the patient was evaluated, we set a program, then the patient was discharged to a “functional maintenance program” with CNA’s who followed through with their program, outside of any PT supervision whatsoever.

Also when a friend of mine had his clinic audited several years ago, he was told that even if the patient was receiving the same exercise program for 3 visits of PT, that could be considered non-skilled services. Even inside of each session, if the patient was receiving 1 hour of therapeutic exercise, then they did not even want to pay for that. They explained that the “skilled part” of the ther ex was determining that they needed that particular exercise and setting the parameters, not the actual performance of the exercise. So they only wanted to pay for the thought program to set the program….as what I would be doing in scenario #2. And if a drastic change of program or re-assessment was necessary, then I would jump in again, for one session, to take measurements, set new program.

Your logic here is good, but I’ve been out of the Medicare game so long that I’m afraid to confirm/deny what they would consider skilled PT Therex or just ‘fitness.’ If I were you, I would call Medicare for clarification on this specific scenario. Then call 5-10 more times and ask the same questions. You’ll likely get at least 2-3 different answers, but you can get an idea from them of what is likely correct. Make sure you document all phone calls and the reasoning behind your decisions and conclusions.

each Fiscal Intermediary sets their own “rules” for interpretation of CMS mandates. Our new FI rules read about the same as what Dylan says unfortunately.

Hi Dr. Carter,

Thank you so much for all your work.

In the summer of this year 2013 I will be opening a pediatric therapy cash based practice. I am wondering if this is the same scenario applies for Medicaid Patients. I will be providing therapy services as well as wellness group classes for children with motor disabilities and educational workshops for parents. What happens from submitting the mandatory claim? Am I now subject to their fees?

Hi Karen, somehow I missed this comment and I deeply apologize for the delayed reply. Unfortunately, I don’t have an answer to your question. Medicaid differs from state to state so you would need to call the Medicaid governing offices in your state and ask them.

Dr. Carter,

I am an OT (who apparently thinks more like a PT) and am considering doing cash based manual therapy. My question is this, if I have not registered with Medicare on their PECOs system as an individual provider, but I have worked PRN and another previous job treating Medicare patients, am I by default already considered “participating” by virtue of having already worked with MC patients in these other positions? i.e. Can they somehow “track me down”? Thanks for such an informative site.

If I were you, I would call CMS and ask them this question. They should be able to tell you if you are registered as a participating provider and what you need to do to remove yourself from their system. Best of luck!

Just recently found your website. I am a PT in Texas and although late, in regards to having an MT or ATC and a PT and being held to the higher standard – according to our PT board rules, you can do MT or ATC services as long as you do not let the person know you are a PT and that you are not providing PT. I would guess a lawyer could come up with a waiver in which you state under which license you are working and the patient agrees. OR you have an entirely different business entity for PT versus the other services. Another expense, but it could save your license in states which do not have direct access.

Love all of the information – so helpful in getting started!

Glad you find the site useful!

As for utilizing other licenses to get around the Medicare-PT-Access restrictions, I would definitely utilize an attorney to guide you through that process safely … probably a lot of tricky gray areas, and I wouldn’t be comfortable giving definitive advice in that area.

I have had a cash based private practice for over 15 years. We do not participate with any insurance companies, contingency plans or government plans including Medicare. This has been frustrating to turn away patients who are on Medicare and want our services and for the patients who have experienced our care and want to continue past the age of 65. I have read your site with interest in an effort to determine which of these patients fall under the various categories of non covered service or wellness/fitness. I happened upon the AARP website and found these two articles which reported on a lawsuit successfully won against Medicare which would now allow “maintenance” care for chronic illnesses to maintain the current condition rather than needing to show continual improvement of a patients condition. The site for these articles are :http://blog.aarp.org/2013/02/06/amy-goyer-medicare-pays-for-skilled-therapy-for-maintenance-with-chronic-illness/ and, http://blog.aarp.org/2012/10/25/amy-goyer-medicare-ruling-helps-caregivers/. The article lists certain chronic conditions but adds, “not limited to”, which as usual, gives us another gray area to navigate around. I was wondering what your thoughts were and how this may change seeing a patient for “maintenance” with a diagnosed chronic condition.

Unfortunately, if “Maintenance care” is now a “covered service,” this will limit us even further in what types of treatment we can provide MC Beneficiaries.

I have a cash based practice, and I have a couple patients who I have been seeing for years with chronic issues who have recently aged into medicare. I have recently become aware that there may be legal issues with continuing to see them and found your website in my search for information. How do I determine if their issues would be considered maintenance by medicare? These patients previously submitted claims to their insurance and were reimbursed although in treatment we are working on pain management and not really meeting functional goals. Would I need to require them to sign an ABN if I do not have a relationship with medicare? That part was difficult for me to understand. How do you handle this situation in your practice. Do you turn away long term patients once they age out? I really don’t know what to do…

I appreciate your advice.

Good question Debbie. I’ve only had a few patients in the situation you describe and luckily we work on more of a maintenance/wellness level, so it hasn’t been an issue. It sounds similar for you, so I would definitely have them sign and ABN and make it clear that they will no longer be able to send in self-claims and receive any reimbursement. It’s such a frustrating bummer, but this is just how it is for now.

THANK YOU for this series of posts! I have called “said professional organization” from above, to try to clarify these issues, with no success as of yet. I stumbled upon your site, and appreciate the info very much. I have owned a small pediatric PT office for 7 years, and have provided only peds PT services, with 70-80% Medicaid population (NC), and also participate with a number of private insurances. I have recently obtained certification in all levels of Total Motion Release (TMR), which is the best thing I’ve ever learned. I have seen such amazing results with my peds population that I wanted to take it to not only adolescent athletes, but people of all ages and goals. I am also certified as a nutrition coach. I opened a subsidiary business, a “DBA”, and that business is cash-based, to provide specifically TMR and nutrition coaching (got my liability insurance company to recognize this, as well). To this point, I have had no Medicare beneficiaries as clients, but I see that as a possibility in the future (or did, anyway, until I learned about the inability to have them pay cash except in certain circumstances). I’m trying hard to learn the specifics of the rules. As I read through the many comments and replies here, I am wondering about the HIPAA regulation going into effect 9/23 that provides “the patient’s right to request that a health plan not be informed of treatment which is paid for in full by the individual”… so what if this is the mutual agreement between me and my client at the point of initial contact? Surely Medicare is not exempt from this newly established “right” people have????

Thanks for the questions Emily. This is a topic I was already investigating and will actually have a full blog post on it in a 2-series update on Medicare and Cash-Based PT (over the next three weeks), so keep an eye out for those. In short, technically and legally, in some situations you might be okay using the HIPAA rule change as a “loophole” but you need to keep in mind a very important part of the language in the new rules: “of his/her own free will.” The blog post will go into deeper detail, but I would be very careful about making the policy of using this loophole with all prospective Medicare patients … if CMS feels you are influencing anyone to sign something or agree to not have Medicare billed, the penalties could be significant.

Jarod,

Thank you for starting this blog. It is so helpful to know that other therapists are dealing with these issues and that someone has done research and is providing some guidance and a forum for discussion.

I just started my own practice 3 months ago and am in the process of becoming a PLLC , which means my tax id number will change. Previously i worked for an outpatient clinic under a non participating status. Like everyone else on this site I have called medicare in the past and received no believable or conclusive answers to my questions.

This gets very involved. If i was a non participating provider for my previous employer, but am now doing business under my own social security number, am I still a medicare non- participating provider and required to charge the set rate for upfront payments by medicare patients? OR am i considered out of the medicare system?

I have a previous patient whom I’ve been seeing a few weeks at home who had exhausted the cap and has a secondary insurance as well. He is planning on submitting to the secondary. I am charging him a preferred rate which is lower than non medicare patients. He had an emergency surgery in April and he has mentioned sending in receipts to his secondary and or medicare. I agreed he could send them into his secondary thinking this is ok. Am I required to charge the same rates to all patients? Am I out of the medicare system or in it? Am I still under a non participating status? As my business becomes a PLLC (billed under different tax id) how will this affect interpretation of the rules? Whew…I know that’s a lot. Any thoughts?

Thanks for the questions, Tonya, but unfortunately many of these questions have significant legal consequences, and I therefore really need to defer you to your attorney on this one.

It sounds like this patient’s physical therapy would be considered medically necessary (especially given his surgery just a few months ago), so he probably needs to go through the exception process to see about getting it covered by Medicare. If Medicare determines that the services are not medically necessary, you could then provide him with an ABN and see him on a self-pay basis, but I would not do this until Medicare denies the coverage of his services. Of course in order for any of this to occur, you need to be either participating or non-participating provider to send in such claims, which goes back to your first question about whether or not you are still in their system. Again, pretty complex issues and definitely best if you get the help of an attorney. Wish I could be of more help.

Best of luck, and please let us know what final answers you receive for these important and tricky issues.

Hi Jarod,

First if all, thank you for all the invaluable information you provide on your site and for maintaining this forum for PTs to ask questions and share ideas. I have a cash based business and my question has to do with “Medicare replacement plans.” I have a former patient who recently turned 65. She has a chronic condition & is in need of services again. I explained that I was unable to treat her now since I have no relationship with Medicare. She is under the impression that she technically doesn’t have Medicare, because she has a “replacement plan with benefits beyond what Medicate pays for.” She even contacted her insurance company and was told that she could seek reimbursement for my services as an out of network provider. Apparently, the person she spoke with also sent her this in writing. I still don’t think I can technically see her, but hoping you can clarify. Thanks!

Hey Jennifer,

Just wanted to let you know that I have started a search for the answer to this question, but I’m waiting to hear back. will let you know.

I am a PT doing MFR in cash pay setting. I was just wondering if TRICARE is under the same regulation as Medicare for cash pay? I have an ex military client who is interested in seeing me for MFR in place of his usual massage/chiropractic cash pay treatments (neither of these are considered covered under Tricare). Since this is for a chronic condition, if I do manual therapy / MFR could it be considered for “wellness” since he has continued to need these services ongoing for several years. I also saw that Tricare only covers 4 visits for “myofascial pain dysfunction”. Thanks for your insight!

Great question Sheri. I reached out to the APTA for some guidance on the Tricare coverage regulations. Will let you know when I know more.

As for the wellness question… I think this is a gray area and you have to be really careful here. If what you are doing could be considered skilled physical therapy, you may be pushing legal boundaries to label and bill it as “wellness.” I know that plenty of PT’s out there do so, but that doesn’t mean you wouldn’t get in trouble for doing so as well.

If I understand correctly, all PT have to submit to Medicare, for Medicare patients, even if they’re not in the system. I have pudendal nerve entrapment, & there are no qualified providers in my area, but the PT said they can’t accept my cash. I want to call back & deny I have Medicare. If I, a patient lie, then they can’t get in trouble.

Or on the other hand, how can I fight this law legally? When I called Medicare twice, they denied that I couldn’t go to any PT & pay cash. Their workers don’t know about this law. Who should I talk to or write to? I am very sick, & i am outraged at this. Doctors don’t have to accept Medicare payment, so why should PT?

Dear Adele,

I am so sorry to hear about your situation. Yes, these laws are absolutely ridiculous. But in your specific situation, there is hope! Since early 2013, changes in the HIPAA laws have given all consumers the right to request that any healthcare provider do NOT send any of their protected health information into Medicare or other third-party payers. Please read, and have the physical therapist you are interested in working with read, this article: https://drjarodcarter.com/cash-based-medicare-hipaa-loophole/

You should be able to write this therapist a letter requesting that they do not send any of your information into Medicare, and because this is all of your own free will, they should be able to treat you and accept cash payments from you.

Best of luck. Please let me know if you have any other questions.

Jarod

Can a cash based practice charge the cash rate to a Medicare Advantage Plan Patient? I assuming the answer is yes because the patient has assigned their medicare benefits to a private insurance company that the practice does not participate with….However it is understood that the coding (PQRS and functional reporting) must be consistent with medicare even though they are not billing medicare (fee for service)

Hi Barrie,

Great question, but unfortunately this is one with legal consequences and I need to defer it out to an attorney. I’ve never personally been in that situation so I can’t give my individual story/experience with it. I’m still waiting for a solid clear answer on whether or not we can see MC beneficiaries with Medicare Advantage plans on a cash-pay basis. I know that many PTs do, but I’ve been given conflicting information from more than one source so far.

If I were you, I would really consider reaching out to an attorney who specializes in Medicare to ask this very specific question … in terms of the actual rate you can charge, I believe that some states have state laws which may also have an affect on this.

Jarod, we are beginning a cash based practice, some wellness and prevention and some physical therapy. We have decided to not treat Medicare patients for physical therapy for now. If I have a training client who has United Healthcare as his primary insurance, and is enrolled in Medicare part A, not in part B, does that still technically mean he is a medicare enrollee and cannot be treated by me?

If he truly only has part A, and NOT part B, then he has no Medicare coverage for your outpatient PT services, and you should be fine to deal with him as you would any pt with United Healthcare insurance

I’m a Medicare patient, but I need pudendal pain physical therapy. In plain language, why can’t I hire a PT to help me for cash? Doctors do it. They opt out of the Medicare program. So why can’t physical therapists? I’d like to know the number of this law so I can go to my congressman and find out what’s going on. I called Medicare & they said they didn’t care if I pay cash. I truely don’t understand what’s going on. Please quote the law to me, so it can be changed. Why haven’t physical therapists gone go the news with this situation, which is bad for patients & PT? What is the “real ” problem, & what is Medicare trying to force on physical therapists?

Hi Adele,

I fully understand your frustration. Don’t worry, there’s hope! I’ll explain below how you can legally see a PT for cash below, but first I’ll answer your question about the source of this ridiculous law:

Section 1802 of the Social Security Act (SSA), as amended by section 4507 of the Balanced Budget Act of 1997 (BBA97) permits a physician or practitioner to “opt out” of Medicare if specific requirements are met. Prior to enactment of the Medicare Prescription Drug, Improvement and Modernization Act of 2003, Section 1802 (B)(5)(B) of the SSA limited the types of physicians who may choose to opt out of Medicare to doctors of medicine and doctors of osteopathy. Section 603 from the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 added dentists, podiatrists, and optometrists to the definition/list of physicians who may opt out of Medicare (The term “Physician” is defined here in Section 1861 (r) of the SSA). These newly added physicians could opt out of Medicare effective December 8, 2003.

Also, for purposes of this “opt out” provision, the term “practitioner” (outlined in SSA section 1842 (B)(18)(C)) means any of the following to the extent that they are legally authorized to practice by the State and otherwise meet Medicare requirements:

physician assistant

nurse practitioner

clinical nurse specialist

certified registered nurse anesthetist

certified nurse midwife

clinical psychologist

registered dietician or medical nutritional therapist

anesthesiologist assistant

clinical social worker

Rather than providing links to all the legislation above (some of which are “out of date”), it is all summarized by CMS here in Section 40 of Ch 15 of the Medicare Benefit Policy Manual

Physical therapists are not part of either list of “physicians” or “practitioners” in the legislation. Sad, but true.

HOWEVER, Adele, you DO have the right to refuse the submission of claims to Medicare, and as long as you make that request of your “own free will,” you should be able to go to any PT (regardless of their relationship with Medicare) and say something along the lines of “I don’t want you to send claims to Medicare. I simply want your treatment and I’m happy to pay you in full out of pocket.” In this scenario you also must understand that you cannot send in self-claims later. It would be a private contract between you and the PT, and it is your right to request this scenario and refuse to have claims submitted.

This right is due to the ONE exception to the “Mandatory Claims Submission” rule which applies to all healthcare practitioners:

The exception to this rule comes from section 40 of chapter 15 of the Medicare Benefit Policy Manual (starting at page 22 of this link):

“The only situation in which non-opt-out physicians or practitioners, or other suppliers, are not required to submit claims to Medicare for covered services is where a beneficiary or the beneficiary’s legal representative refuses, of his/her own free will, to authorize the submission of a bill to Medicare.”

Is Tricare under the same rules as Medicare concerning cash pay?

Thank you for all you do to help educate us!

You are most welcome, William.

I answer your question (among many others) in detail in my eBook on Medicare and Cash PT, but in short, yes the rules are the same …

From my research, retirees must have Medicare Part B in order to have Tricare for Life. There are a few exceptions to this rule, so you’ll need to confirm with each patient, but most of these patients will have Medicare Part B coverage.

Furthermore, Medicare is the “Primary Payor” and Tricare is the secondary payor. So, with all this being the case, I can only assume that you cannot provide Tricare beneficiaries with covered services on a cash-pay basis any differently than any other Medicare beneficiary with Part B coverage (because Medicare has to pay first). Like with any other Medicare beneficiary, there should not be a problem with providing non-covered services on a private-pay basis.

Dr. Jerod Carter,

Thank you for the information you provide, especially on Medicare. I am a patient that wants to protect my PT Provider. I have suffered from a rare condition that few PT’s are qualified to treat. I am on Medicare Disability and the best provider for me runs a cash business who will not treat Medicare patients because of concerns you’ve addressed. This PT offers the best hope for me so I want her to treat me. She doesn’t know I’m on Medicare and I don’t plan on telling her. I do want to protect her by not submitting insurance claims to Medicare. Am I fully insulating her and her business or is there something else I should be doing? I know this seems crazy but I have suffered for 15 years, and seen countless providers. So I will do whatever it takes with in reason to get the best care. May be I can get off disability before I die, saving the government money.

I am so very sorry to hear of your situation. To answer your question, YOU HAVE THE RIGHT to request that your provider do not send claims to Medicare for the services you’re receiving. If you make that request of your own free will, and they document that request, they should not be in danger by providing you with PT services on a cash-pay basis.

Dr Jarod Carter,

Sorry I spelled your name wrong in previous email

David Myers

No worries David!

I was approached to see a pt privately (either at their home or at my clinic), but they are receiving Home Health PT 1X/week. The spouse wants his wife to have more than what HH can offer in our area. They are willing to pay out of pocket. Can I do this?

Does anyone have information about the wellness process for Medicare and whether or not massage or soft tissue mobilization can be provided for wellness patients or if it truly designed to just be supervised exercise programming. It’s a bit unclear in the research I have done.

Medicare advantage is coverage by a Private company, people with advantage plans are NOT on Medicare they are getting coverage by a private insurance provider. The provider agrees to cover the same problems as original Medicare but they are able to determine IF the patient needs the service and they can limit the service to whatever level they choose. I would think that people on advantage plans can be seen as private pay patients since they have absolutely no connection to Medicare any longer. All advantage plan participants are no longer covered by traditional government programs, they are in fact covered by a Private Insurance carrier who simply agrees to cover the same categories of government Medicare but they can in fact determine when and if it is needed and how much of the service they will cover and they can determine how much they will pay for it.

This happens to be the great disadvantage of advantage plans. But I cannot see how Physical Therapists cannot bill privately people on advantage plans. These people are covered in total by a private insurance company, with no coverage whatsoever from government Medicare.

Thanks for posting this information! Is there a reference for the no relationship with medicare from cms that we can reference for patients who do not understand. Thanks